Yakima County profile

by Don Meseck, regional labor economist - updated April 2022

by Don Meseck, regional labor economist - updated April 2022

Overview | Geographic facts | Outlook | Labor force and unemployment | Industry employment | Wages and income | Population | Useful links | PDF Profile copy

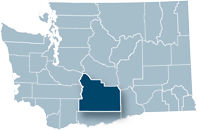

Regional context

Yakima County is located in south central Washington state among seven neighboring counties. The geography varies from densely timbered, mountainous terrain in the west, rolling foothills, broad valleys and arid regions to the east and fertile valleys in its central and southern parts. Agriculture has been the staple of the economy over the last 100 years.

According to the Yakima County Economic Profile published by the Yakima County Development Association’s New Vision office, Yakima is the second largest county in Washington state at 2.75 million acres. Three entities own 63.4 percent of this total:

- The Yakama Nation (1,074,174 acres)

- The U.S. Forest Service (503,726 acres)

- The Yakima Training Center (165,787 acres)

Yakima County was separated from Kittitas County in 1883. Yakima County’s development was shaped largely by the Northern Pacific Railroad and the Yakima River. Most of the county’s population is concentrated along this river, largely because irrigation was critical to the success of the communities and the farmers who settled in this area.

The Washington Legislature passed the State Fair Act in 1893 and designated North Yakima in Yakima County as the site for an annual State Agricultural Fair. Some say it was a consolation prize for Yakima, which lost its bid to Olympia to be named the state capital.

Local economy

Yakima settlers developed the land into a commercial agricultural enterprise in the 1880s. With irrigation and railroads, commercial fruit production flourished. Yakima established wine grape vineyards in 1869 and hops acreage in 1872, which remain major parts of its agricultural industry today. Forestry and livestock, dairies and the growing, storage and shipping/processing of deciduous tree fruits (apples, cherries, pears, etc.), are bedrocks of Yakima County’s economy.

In terms of jobs provided, agriculture is certainly the “big kid on the block” in Yakima County. The two other local industries in second and third place in terms of employment are health services and local government. Specifically, on an average annual basis in 2020, agricultural employers provided 30,767 jobs, or 27.8 percent of total covered employment countywide. Health services provided 16,543 jobs, or 14.9 percent; and local government averaged 13,079 jobs, or 11.8 percent of total employment. Hence, these three industries/sectors accounted for well over half (specifically 54.5 percent) of total covered employment (110,800 jobs) in the county in 2020.

| Yakima County | Washington state | |

| Land area, 2010 (square miles) | 4,295.4 | 66,455.5 |

| People per square mile, 2010 | 56.6 | 101.2 |

(Source: U.S. Census Bureau QuickFacts)

There is a generalization about the Yakima County job market that: “In good years we grow slower than Washington state, but in the bad years we do not lose jobs as rapidly as the state.” A relatively long-term view of average nonfarm job growth rates from 2009 through 2021 generally supports this “rule:”

- Following the 2007 to 2009 national recession, Washington’s and Yakima County’s job markets were hit hard. Washington’s nonfarm job-loss rate in 2009 was -4.4 percent, while Yakima experienced a less severe -1.7 percent loss rate. In 2010, the loss rates were -0.9 percent statewide versus a more modest -0.4 percent in the county.

- Annually from 2010 to 2019, nonfarm job-growth rates in Yakima County were not as strong as those experienced statewide.

- During the COVID-19-related layoffs of 2020, the job-loss rate in Yakima County (-5.0 percent) was a bit less severe that the -5.4 percent loss rate across Washington.

- In calendar year 2021, the 2.5 percent average annual upturn in nonfarm employment in Yakima County exceeded the 2.3 percent average annual nonfarm job growth rate for Washington state.

The main reason for this good news/bad news scenario in the local economy is likely that the agricultural industry (which provided 27.8 percent of total covered employment in 2020) exerts a moderating effect on Yakima County’s labor market.

Yakima County’s nonfarm economy added 2,100 jobs in 2021, an average annual increase of 2.5 percent, as rehiring occurred following COVID-19-related layoffs during 2020. Year over year, total nonfarm employment contracted from April 2020 through March 2021 before expanding in the past 11 months (April 2021 through February 2022). Recently, nonfarm employment advanced by 5,200 jobs (up 6.4 percent) countywide, rising from 81,800 jobs in February 2021 to 87,000 in February 2022. (Please note that February 2022 CES estimates were the most current data available at report preparation time.)

The Local Area Unemployment Statistics (LAUS) program enables our agency to provide county-level, Civilian Labor Force (CLF) estimates and, from these data, to calculate monthly unemployment rates. LAUS data, current as of March 29, 2022, shows that Yakima County’s CLF decreased by -1.7 percent between 2020 (133,379 residents) and 2021 (131,144 residents). But after 13 consecutive months (July 2020 through July 2021) of contractions, the local labor force either stabilized or expanded from August 2021 through February 2022. This February, there were 130,128 residents in the labor force versus 125,144 in February 2021, a 4,987 resident and 4.0 percent increase. Also, the number of unemployed dropped by -11.8 percent as 1,452 fewer residents were out of work in February 2022 versus in February 2021. This labor force expansion, coupled with a contraction in the number of unemployed, helped push Yakima County’s unemployment rate down from 9.8 percent in February 2021 (during the end of COVID-19-related layoffs) to 8.3 percent in February 2022.

These CES and LAUS estimates through February 2022 indicate a rebounding of the Yakima County economy in 2021 and into 2022. However, how long this economic resurgence will last is uncertain. Much depends on whether the COVID-19 virus can be contained and/or eradicated. The effect of rising interest rates on national and local labor markets are also a concern. Nevertheless, our dauntless staff in the DATA Division of the Washington State Employment Security Department (ESD) have prepared long-term (i.e., 10-year) industry employment projections indicating a 0.1 percent average annual nonfarm growth pace from 2019 to 2029 for the four-county (Kittitas, Klickitat, Skamania and Yakima) South Central Workforce Development Area (WDA) and a 0.4 percent growth rate for Washington state during this timeframe.

The National Bureau of Economic Research (NBER) announced that the recent “great” national recession occurred from December 2007 through June 2009. But the effects of this recession hit Yakima County’s labor force primarily in 2010 and 2011 when unemployment rates averaged 10.6 percent in 2010 and peaked at 10.7 percent in 2011. From 2012 through 2018 the average annual unemployment rate in Yakima County decreased. In fact, the 6.3 percent rate for calendar year 2018 is the lowest reading since our agency began compiling data electronically in 1990.

In 2019, Yakima County’s not seasonally adjusted rate moved upwards to 7.1 percent followed by a sharp two and three-tenths percentage point jump to 9.4 percent during the heyday of the COVID-19 pandemic in 2020. Yet, as high as this unemployment rate was in 2020 (i.e., 9.4 percent), it did not equal the extremely high 10.7 percent reading during the recent Great recession.

In calendar year 2021, a recovery began in Yakima County’s CLF. Although in aggregate the county’s labor force shrank by -1.7 percent between 2020 (133,379 residents) and 2021 (131,144 residents), these losses occurred in the first seven months of 2021. From August 2021 through February 2022, the CLF either stabilized or expanded year over year – good economic news. The only downside is that the number of residents in Yakima County’s labor force in February 2022 was still less than it was prior to the COVID-19-induced recession. Specifically, the 130,128 residents in the local CLF this February were 1,049 residents fewer (and -0.8 percent lower) than the 131,177 residents in the labor force back in February 2020. Fortunately, the trend is clearly moving in the right direction. Residents are rejoining the labor force. It is likely that the number of residents in the CLF will soon return to where it was prior to the COVID-19 pandemic.

Source: Employment Security Department/DATA Division

Current industry employment statistics are available on the Labor area summaries page.

The analysis in the first part of this section is derived primarily from the Current Employment Statistics (CES) survey sample and Washington Quarterly Benchmarked (WA-QB) data. Advantages of these data are that each month Employment Security Department (ESD) economists estimate job gains and losses based on the survey of employers (CES). The next month, these estimates are replaced with revised estimates. Then, at the end of each quarter, economists revise these estimates based on actual numbers from employer tax records (QCEW). The process that replaces employment estimates with the actual number of job gains or losses is called benchmarking. While ESD benchmarks our data quarterly, the Bureau of Labor Statistics (BLS) benchmarks its data once a year. However, a limitation of WA-QB estimates is that they are nonfarm related (i.e., agricultural employment figures are not included).

The analysis in the second part of this section are derived from the BLS’ QCEW program, conducted by ESD. Although it takes a little longer to acquire QCEW data (than WA-QB data), the economic information provided is broader and more detailed than that provided by WA-QB. First, QCEW includes employment, wage and size of firm figures for the agricultural sector, which WA-QB does not include. Second, QCEW data provide employment, wage and size of firm figures for businesses and government organizations in Yakima County down to the 3-digit NAICS sub-sector level (i.e., more detail than WA-QB). QCEW data include agricultural and nonagricultural employment and wages for firms, organizations and individuals whose employees are covered by the Washington State Employment Security Act. Also included are data for federal government agencies covered by Title 5, U.S.C. 85. Covered employment generally exceeds 85 percent of total employment in the state of Washington.

Types of jobs not covered under the unemployment compensation system, and hence not included in QCEW data, include:

- Casual laborers not performing duties in the course of the employer’s trade or business

- Railroad personnel

- Newspaper delivery people

- Insurance or real estate agents paid on a commission basis only

- Non-covered employees working for parochial schools, religious or non-profit organizations

- Employees of sheltered workshops

- Inmates working in penal institutions

- Non-covered corporate officers, etc.

Analysis using CES Washington Quarterly Benchmarked (WA-QB) data:

The National Bureau of Economic Research (NBER) announced that a national recession occurred from December 2007 through June 2009. However, the effects of the recession hit Yakima County’s nonfarm labor market heavily in 2009, 2010 and again in 2012 with employment low points or “valleys” occurring in 2010 and in 2012 when nonfarm employment countywide averaged just 78,400 (in both years). Please note that nonfarm employment data do not count agricultural jobs. Nonfarm figures are derived from CES sample-based estimates and from WA-QB data.

The “pre-recession” peak for nonfarm employment was in 2008 when the local economy provided 80,100 jobs. Then the recession hit, and it took seven years (until 2015) for Yakima County to surpass this 80,100-job level (of 2008). In 2015, nonfarm employment averaged 81,700 jobs. Hence, this recession hit Yakima County’s nonfarm market harder than the total covered employment market (which includes agricultural jobs). Specifically, the “pre-recession” peak for covered employment was in 2008 when the local economy provided 101,084 jobs. The recession depressed job levels countywide in 2009 and in 2010, but by 2011, total covered employment bounced back to 101,249 jobs above its pre-recession peak. Why the difference? Most likely it is the relative importance of agriculture and agriculturally dependent industries to the local economy.

Following is a summary of average annual nonfarm job changes in the last three completed years (2019 to 2021, inclusive):

- In 2019 – The Yakima County economy netted 300 more nonfarm jobs as employment rose to an average of 87,100 (up a modest 0.3 percent). Two Yakima County industries accounted for most of the total nonfarm job growth in 2019: health care and social assistance (up 300) and professional and business services (up 200). On the downside, retail trade averaged 300 fewer jobs in 2019 than in the prior year. Washington’s nonfarm market expanded at a more rapid 2.0 percent clip in 2019.

- In 2020 – COVID-19-related layoffs wreaked havoc in the local economy. The nonfarm market averaged 4,400 fewer jobs in 2020 than in 2019. The number of total nonfarm jobs fell to 82,700 (-5.0 percent). Yakima County’s leisure and hospitality and local government sectors lost 1,700 and 1,000 jobs, respectively. No major local industry posted significant job growth. Washington’s nonfarm market contracted at a -5.4 percent pace in 2020.

- In 2021 – The local economy netted 2,100 more nonfarm jobs in 2021 than in 2020, as total nonfarm employment rose from 82,700 jobs to an average of 84,800 (up 2.5 percent). Leisure and hospitality, so decimated by the onslaught of the COVID-19 pandemic in 2020, bounced back by adding 900 jobs (up 13.2 percent) in 2021. Retail trade lengthened their payrolls by providing 600 more jobs (up 5.3 percent). Nondurable goods manufacturing (primarily food processing) in Yakima County slipped by 100 jobs (-1.6 percent) in 2021. Washington’s nonfarm market expanded at a 2.3 percent clip during 2021.

Analysis using QCEW data:

The North American Industry Classification System (NAICS) is an industry classification system that groups businesses/organizations into categories or sectors based on the activities in which they are primarily engaged. There are 19 private sectors and 3 government sectors (for a total of 22 sectors) at the two-digit NAICS code level, within each county-level economy. One can observe much about the structure of a county’s economy by quantifying and comparing the number of jobs and the percentage of jobs in these sectors by using average annual QCEW data. The most recent average annual covered employment, or QCEW, data available for Yakima County are for 2019.

The top five Yakima County industry sectors in 2020 in terms of employment were:

| Sector | Number of jobs | Share of employment |

| 1. Agriculture, forestry and fishing | 30,767 | 27.8% |

| 2. Health services | 16,543 | 14.9% |

| 3. Local government | 13,079 | 11.8% |

| 4. Retail trade | 10,623 | 9.6% |

| 5. Manufacturing | 8,010 | 7.2% |

| All other industries | 31,778 | 28.7% |

| Total covered payrolls | 110,800 | 100% |

Over seventy percent (71.3 percent, to be exact) of all jobs in Yakima County in 2020 were in these five, two-digit NAICS industries or sectors (i.e., agriculture, health services, local government, retail trade and manufacturing). The fact that these five sectors (of the 19 private sectors and three government sectors in the two-digit NAICS coding system) account for such a large percentage of total covered employment, indicates that Yakima County’s economy is not tremendously diverse.

A comparison of the top five sectors that provided the most jobs in Yakima County in 2020 with the sectors that produced the highest payrolls shows that:

- Agriculture provided 27.8 percent of all jobs countywide but supplied only 22.5 percent of total wage income. Why? Many agricultural jobs are seasonal.

- Conversely, private health services tallied 14.9 percent of total covered employment but accounted for 16.0 percent of total wage income – indicating it is a relatively “good-paying” industry.

- Local government provided 11.8 percent of total covered employment but accounted for 14.6 percent of total wage income, indicating that this is a relatively “good-paying” industry. Jobs with local public school districts (primary and secondary schools) are tallied under the local government category. Jobs and wages at Native American (tribal) organizations are also tallied under the local government category, along with county and city-level public health care providers, police and fire departments, municipal courts, public works, etc.

- Retail trade businesses accounted for 9.6 percent of total covered employment countywide yet provided only 7.4 percent of total wage income. The primary reason is that a relatively high percentage of jobs in the retail trade industry are part time.

- Conversely, manufacturing supplied only 7.2 percent of total covered employment in Yakima County but accounted for 8.9 percent of total wages/payroll. It is also interesting to note that the food manufacturing (NAICS 311) and beverage and tobacco product manufacturing (NAICS 312) subsectors accounted for 41.4 percent of all manufacturing sector (NAICS 31-33) jobs in Yakima County in 2020. Although these subsectors are grouped under manufacturing (NAICS 31-33), they are clearly agriculturally dependent.

An analysis of covered employment changes in Yakima County from 2010 to 2020 (eleven years, inclusive) using QCEW data, shows that total employment increased from 99,953 in 2010 to 110,800 in 2020, a 10,847 job and 10.9 percent expansion. Of the 22 NAICS sectors, the “top five” sectors in 2010; agriculture, local government, health services, retail trade and manufacturing (ranked by employment from highest to lowest) accounted for 67.2 percent of all jobs countywide. The same “top five” accounted for 71.3 percent of total covered employment countywide ten years later in 2020. However, two sectors switched rankings during these 10 years. Local government slipped from “number two” (in terms of covered employment jobs) in 2010 to “number three” in 2020, while health services rose from “number three” in 2010 to “number two” in 2020. This indicates that Yakima County’s health services sector (NAICS 62) has assumed a relatively larger role in terms of employment during the past 10 years in the local economy.

Five sectors in Yakima County added the most jobs from 2010 to 2020:

- In terms of industry sectors generating the greatest number of jobs in the most recent 10-year period (2010 to 2020, inclusive), agriculture (NAICS 11) ranked first. Employment in agriculture, forestry and fishing (where most jobs were in agriculture) jumped 29.1 percent and 6,942 jobs (from 23,825 jobs in 2010 to 30,767 in 2020) — an annualized growth rate of 2.6 percent. Total covered employment rose 10.9 percent and 10,847 jobs (from 99,953 jobs in 2010 to 110,800 in 2020) for an annualized growth rate of 1.0 percent. Approximately 64.0 percent of all covered jobs gained during this timeframe were in the agricultural sector (NAICS 11) and the agricultural subsector, wherein most of this job growth occurred in agriculture and forestry support (NAICS 115). In 2010, this subsector tallied 6,514 jobs. By 2020, this number jumped to 11,332, a 74.0 percent and 4,818 job upturn. Much of the robust NAICS 115 hiring occurred in post-harvest crop activities (marijuana production) and amongst farm labor contractors (related to the H-2A program).

- Health services (NAICS 62) registered a strong 27.2 percent expansion with a gain of 3,541 jobs, rising from 13,002 jobs in 2010 to 16,543 in 2020. This ranked health services as number two (of all 22 NAICS sectors/categories) in terms of jobs added countywide from 2010 to 2020. It is also significant that the health services industry in Yakima County improved its “status” from the sector with the third-largest number of jobs in 2010 (behind agriculture and local government) to the second-largest number of jobs in 2020.

- Construction (NAICS 23) employment grew by 36.4 percent and 995 jobs, from 2,734 jobs in 2010 to 3,729 in 2020. Annualized employment growth NAICS 23 businesses between 2010 and 2020 was 3.2 percent versus a 1.0 percent growth rate for total covered employment. On a percentage basis, this was the fastest-growing industry in Yakima County in the most recent 10-year period (2010 to 2020).

- Retail trade (NAICS 44-45) added the fourth-largest number of jobs across Yakima County between 2010 and 2020. Full- and part-time retail employment increased by 766 (up 7.8 percent) from 9,857 jobs in 2010 to 10,623 in 2020, an annualized growth rate of 0.8 percent, which was a little less than the annualized growth pace of 1.0 percent for total covered employment countywide. Of the 12 three-digit NAICS subsectors classified within Yakima County’s retail sector, two accounted for virtually all the new retail jobs added in this period. Building material and garden supply stores (NAICS 444) rose by 385 jobs and 50.1 percent, while general merchandise stores (NAICS 452) grew by 422 jobs and 15.7 percent. Food and beverage stores (NAICS 445) lost 215 jobs (-9.1 percent) from 2010 to 2020.

- Transportation and warehousing (NAICS 48-49) businesses saw employment net 601 more positions in 2020 (3,399 jobs) than in 2010 (2,798 job) a 21.5 percent upturn, to secure its number five position in terms of jobs added in Yakima County during this 10-year period.

Source: Employment Security Department/DATA Division; Quarterly Census of Employment and Wage (QCEW)

Industry employment by age and gender

The Local Employment Dynamics (LED) database, a joint project of state employment departments and the U.S. Census Bureau, matches state employment data with federal administrative data. Among the products is industry employment by age and gender. All workers covered by state unemployment insurance data are included; federal workers and non-covered workers, such as the self-employed, are not. Data are presented by place of work, not place of residence.

Yakima County highlights:

In 2020, women held 48.9 percent of the jobs in Yakima County. However, there were substantial differences in gender by industry.

- Male-dominated industries included mining (84.9 percent), utilities (84.3 percent), and construction (81.2 percent).

- Female-dominated industries included health care and social assistance (79.1 percent), educational services (68.8 percent), and finance and insurance (64.5 percent).

There were some differences in 2020 between Yakima County and Washington state in the percentages of workers by age group:

- Only 20.4 percent of workers in Yakima County in all industries were in the 25 to 34 years of age group versus 23.0 percent statewide.

- Approximately 26.6 percent of workers in Yakima County in all industries were in the 55+ years of age category versus only 23.0 percent statewide.

Source: The Local Employment Dynamics

The total covered payroll in 2020 in Yakima County was nearly $4.9 billion. The average annual wage was $44,223 or 57.6 percent of the state average of $76,801.

The top five Yakima County industries in 2020 in terms of payrolls were:

| Sector | Payroll | Share of payrolls |

| 1. Agriculture, forestry and fishing | $1,101,121,332 | 22.5% |

| 2. Health services | $784,947,681 | 16.0% |

| 3. Local government | $716,410,229 | 14.6% |

| 4. Manufacturing | $434,604,902 | 8.9% |

| 5. Retail trade | $375,947,143 | 7.7% |

| All other industries | $1,486,825,733 | 30.3% |

| Total covered payrolls | $4,899,857,020 | 100% |

QCEW data showed that Yakima County’s workers earned nearly $4.9 billion in wages in 2020. Nearly 7 out of 10 (69.7 percent) dollars of covered wage income was earned in five two-digit NAICS industries or sectors (i.e., agriculture, private health services, local government, manufacturing and retail trade). Agriculture was clearly the largest provider of wages and jobs in the county in 2020, supplying 22.5 percent of total covered wage income and accounting for 27.8 percent of covered employment. Private health services (i.e., jobs at a doctor/dentist’s office, a hospital, nursing home, vocational rehab facility, etc.) ranked second out of 22 industries in 2020 in terms of wages. This industry provided $784.9 million in payroll and 16.0 percent of total earned wage income while accounting for 14.9 percent of total covered employment, indicating that, in aggregate, this is a relatively good-paying industry.

Average annual wages in Yakima County 2020 were highest in utilities ($100,919), management of companies and enterprises ($85,088), and in finance and insurance ($75,915). Conversely, the three sectors tallying the lowest average annual wages were accommodation and food services ($20,139), arts, entertainment and recreation ($24,354) and mining ($33,206).

Personal income

Personal income includes earned income, investment income, and government payments such as Social Security and veterans benefits. Investment income includes income imputed from pension funds and from owning a home. Per capita personal income equals total personal income divided by the resident population.

Inflation-adjusted per capita income in Yakima County in 2020 was $49,099 compared to the state at $67,126 and the nation at $59,510.

Median household income from 2016 through 2020 (in 2020 dollars) was $54,917 in Yakima County, 71.3 percent of the state’s median household income of $77,006 and 84.5 percent of the United States at $64,994, according to the Census Bureau QuickFacts.

Yakima County’s poverty rate in 2020 was higher (14.8 percent) than the state’s (9.5 percent) and the nation’s (11.4 percent) poverty rates according to Census Bureau QuickFacts.

Source: Employment Security Department/DATA Division; Bureau of Labor Statistics, Bureau of Economic Analysis;

U.S. Census Bureau; U.S. Census Bureau, American Community Survey

Yakima County’s population was 256,728 in 2020 and 243,231 in 2010. Washington’s population was 6,724,540 in 2010 and 7,705,281 in 2020. Hence, during this 10-year time frame, Yakima County’s population grew by 5.5 percent, less robust than Washington’s 14.6 percent growth rate.

Population facts

| Yakima County | Washington state | |

| Population 2021 | 256,035 | 7,738,692 |

| Population 2020 | 256,728 | 7,705,281 |

| Percent change, 2020 to 2021 | -0.3% | 0.4% |

Age, gender and ethnicity

Compared with the state, Yakima County’s 2021 population has more children under 5 years old and more youth under 18 years old. Approximately 29.5 percent of the county’s residents are under 18 years old compared to 21.8 percent statewide. However, the county’s population age 65 or older totals only 14.0 percent compared to 15.9 percent in Washington. Therefore, one may generalize that Yakima County has a younger population than Washington state.

According to US Census population estimates as of July 1, 2021, Yakima County had a higher percentage of Latino and Hispanic residents than the state and nation. Specifically, Yakima County’s Hispanic or Latino population comprises 50.2 percent of its population, much higher than Washington state (13.0 percent). Yakima County’s American Indian/Native Alaskan population was 6.7 percent compared to 1.9 percent in the state, reflecting the presence of the Yakama Nation.

Demographics

| Yakima County | Washington state | |

| Population by age, 2021 | ||

| Under 5 years old | 7.8% | 6.0% |

| Under 18 years old | 29.5% | 21.8% |

| 65 years and older | 14.0% | 15.9% |

| Females, 2021 | 50.0% | 49.9% |

| Race/ethnicity, 2021 | ||

| White, not Hispanic or Latino | 42.3% | 67.5% |

| Black | 1.6% | 4.4% |

| American Indian, Alaskan Native | 6.7% | 1.9% |

| Asian, Native Hawaiian, other Pacific Islander | 1.9% | 10.4% |

| Hispanic or Latino, any race | 50.2% | 13.0% |

Educational attainment

According to the American Community Survey, during the period 2016 to 2020, 74.3 percent of Yakima County’s population 25 years and older were high school graduates or higher, considerably lower than the statewide average of 91.7 percent and the national average of 88.5 percent.

Yakima County had a lower percentage of adults with a bachelor’s degree or higher (17.6 percent) compared to the state at 36.7 percent and the nation at 32.9 percent during the same period.

(Source: U.S. Census Bureau QuickFacts)

- County data tables

- Census Bureau County Profile

- 2020 Census State Profile

- Greater Yakima Chamber of Commerce

- Self Sufficiency Calculator for Washington State

- South Central Workforce Council

- Census Bureau QuickFacts

- Port of Grandview

- Port of Sunnyside

- Washington Ports

- Workforce Development Areas and WorkSource Office Directory

- Yakima County Development Association/New Vision

- Yakima County History

- Yakima County home page

- Yakima County on ChooseWashington.com

- Yakima County on ofm.wa.gov